If you’ve decided to buy a home, you may have already started house hunting online to get an idea of how much homes are going for with your criteria. Deciding to buy your first home is an exciting time and can be a rewarding experience with long-term benefits. But in order to benefit from our future investment, we have to do some homework.

In this post I list 10 things you must do, BEFORE you buy a home because if you don’t, you may find yourself overwhelmed and stressed during the home buying process.

Disclosure: This post contains my own thoughts and opinions based on my personal experience as a 3x homebuyer and homeowner. I am not a finance, real estate, or legal professional. Please consult with your professional team for buying a home.

Related Posts:

- How to Create a Budget You Can Stick To

- 9 Best Need to Know Tips for the First-Time Homebuyers

- 21 Ways to Update Your Home on a Budget

- How to Get Started with a Home Renovation

WHAT'S IN THIS POST?

10 Things you must do BEFORE buying a home

Buying a home is a huge financial expense that you are contracted with for 30 years and it’s not a decision to be made lightly. Before you start looking for your dream home, you’ll need a reality check to figure out if you even have enough money to cover the monthly expenses.

Do what works best for you, your lifestyle, and your budget. A Real Estate Agent once told us:

“You don’t want to look at the cost of the home, you want to look at what you can afford per month.”

1. Assess your finances

Understanding your finances is key to buying a home because you don’t want to struggle month-to-month in order to cover the costs of being a homeowner. Although buying a home can be a great long-term investment, it’s not worth it if you lose your home because you defaulted on your home loan.

Take a look at your finances to see where you stand and create a budget you can stick to.

- Check your credit report and credit score for free by using creditkarma.com

- Calculate your debt-to-income ratio

- Review your past spending history

- Estimate a comfortable monthly mortgage payment and expenses – see step 2

- Determine how much home you can afford

Get your free report at www.annualcreditreport.com. A free annual credit report does not include credit scores but is important for monitoring identity theft. Federal law allows you to get one (1) free credit report every 12 months from each credit reporting company (Equifax, Experian, or TransUnion).

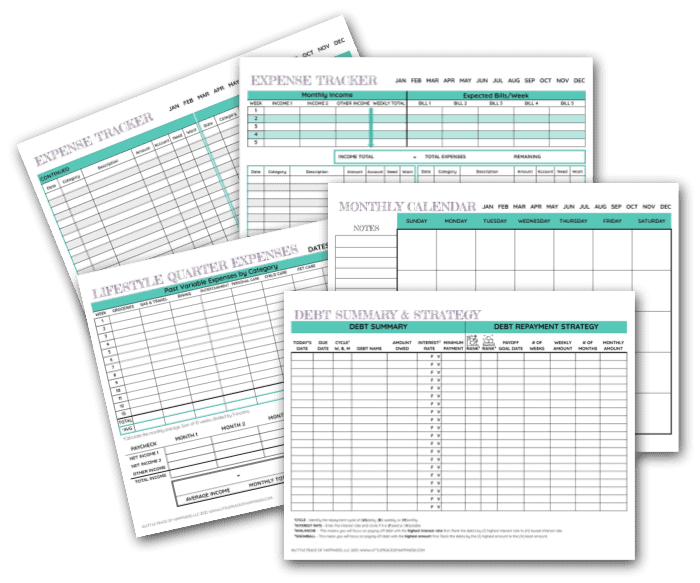

FREE MINI BUDGET KIT!

Come up with a plan to reduce your debt, understand your spending habits, and track your expenses so you can save more money for the things you want.

This kit includes:

- 2 Monthly Calendars (Sunday and Monday Start)

- Debt Summary and Strategy Planner

- Lifestyle Quarter Expenses (Pre-filled and Blank)

- Expense Tracker

2. Have funds to cover more than just the mortgage

As a homeowner, there are additional ticket items that come with having a mortgage. On most real estate websites, you can find information on the additional fees that come with the property that will need to be taken into account in the budgeting process.

The cost of owning a home in a certain location will determine the dollar amount of added fees. Some of these line items can be avoided such as an HOA and PMI, but not all. Here is a summary of the hidden costs of owning a home:

- Property Taxes

- Metropolitan District Taxes – a separate fee built into property taxes, will vary by state statutes

- Homeowners’ Association (HOA) or Condominium Fees

- Homeowners’ Insurance

- Mortgage Property Insurance – If you have a down payment less than 20%

- And additional maintenance expenses in upkeep a home

Use the information provided on the real estate websites to get an estimate of the costs associated with a property. If you have a real estate agent, ask them to assist you with these values so you have a better understanding of expected monthly payments.

3. Be prepared for the costs of buying a home

Buying a home is a big deal so it involves a number of people and has a lot of moving parts. Understandably, this means that there are a few expenses that need to be covered before the keys are officially handed over.

Everyone knows or has heard that they have to save up for a down payment. And if you didn’t before, now you know! Saving up for a down payment is the largest expense you will pay out-of-pocket in the beginning of the financial process. The next large expense lies in the closing costs.

When we purchased our first home, we had very little for a down payment and I honestly didn’t know anything about closing costs. Please forgive me since we were only 22 years old when we purchased our first home, my focus was just finding a place to live before we started our grad school lives. Thankfully, we had a real estate agent who held our hands the whole way. I’m not a financial advisor, banker, or real estate agent, but after going through the home buying process three times, here are the costs you need to prepare for:

- Down Payment – % of home price that is paid upfront

- Home Inspection – a paid service performed while you’re under contract

- Appraisal – a paid service requested by your lender to assess the value of the home of interest

- Home Warranty – a paid insurance that will repair or replace major appliances and home systems (optional)

- Agent Commissions – commissions paid to the seller and buyer agents for the sale – usually seller pays for this, but it could be a possibility for the buyer

- Closing Costs – paid at the time of closing to cover all of the costs associated with the transfer of home

Ask your lender provider or title company to provide you with an estimate sheet of what you need to bring at closing so you can see how it is broken down.

4. Check State and Local Programs

To support the state economy, states may have their own local homebuying programs to assist homebuyers. State and local programs may provide resources such as:

- Free housing counseling for buying, renting, and foreclosures

- Education on how to buy and maintain your home

- Provide funds for home repairs

- How to make your home more energy efficient

Loan requirements may be different today so it is important to understand the loan type, loan term, and interest rate associated with your loan options.

5. Find out where you want to live

Location, Location, Location. Unless you enjoy the 2-hour commute to work, school, or to drop off the kids at daycare, you’ll want to figure out where you want to live. Consider your lifestyle, where you need to go regularly, how will you get there (car, bus, bike, etc.), and how far you are willing to travel.

Search for neighborhoods online using mapping sites such as Google Maps to find out the names of neighborhoods and what amenities are in the area.

6. Research the home you want

Thanks to the power of the internet, you can look at homes in the comfort of wherever you are. Researching a home will help you identify what you love and don’t like about a home. The current home that you’re in can also serve this purpose.

My personal favorite real estate site is Zillow.com and it’s because I found it to be the easiest to use both on the desktop and on the mobile apps. I’ve tried other apps before, but Zillow is what worked best for me. Whatever platform you use, start favoriting the homes you like and when you’ve favorited 10 homes, go back to take a look at them.

Notice what things are in common across your favorited homes, what do you like about them?

Related Posts:

- How to Create a Budget You Can Stick To

- 9 Best Need to Know Tips for the First-Time Homebuyers

- 21 Ways to Update Your Home on a Budget

- How to Get Started with a Home Renovation

7. Make a list of Must-Haves and Nice-to-Haves

When you’re ready to shop for your first home, it is essential to make a list of what you “must-have” versus your “nice-to-have” items in your home. This will help you weigh out the pros and cons of every home tour and help you focus on what is really important to you. This list will also help your real estate agent get a better idea of what you want as a homebuyer.

Two weeks into daily house hunting will start to burn you out if you’re seeing 3-4 homes every time and nothing seems to meet your list. Be patient and don’t compromise on your must-haves and be flexible on your nice-to-haves.

If nothing is coming up, then it could be time to reevaluate your list. Sometimes when we make our list the first time, we may feel that everything is essential. When considering your must-haves, think about what is going to have a negative impact or living experience if you don’t have it. If you’re okay without something then it may just be a nice-to-have, which will be a bonus when you find a home that meets your must-have list plus more.

8. Shop around for the best rates

When you are buying a home, you have the right to shop around for a mortgage without hurting your credit score. Shopping for the best rates may take some time but it will service you in the long run over the length of your home loan. The Consumer Financial Protection Bureau (CFPB) states that you have a 45-day window to contact and run multiple credit checks from mortgage lenders.

On your credit report, this will appear as a single inquiry instead of multiple pulls. Therefore, the impact to your credit will be the same when doing a credit check with a single mortgage lender versus many as long as it is within a 45-day window from your first check.

Use a Mortgage Shopping Worksheet that you can use to compare lenders. The Consumer Information Federal Trade Commission (FTC) also recommends shopping for a mortgage.

9. Find a Real Estate Agent

If you’re new to buying a home and you didn’t grow up in the trade, buying a home on your own can be a hassle. Buying a home without an agent is not impossible. But if you’re treading new waters, I highly recommend that you find a real estate agent to work with and one that will provide you with great customer service.

There are many real estate agents out there and you may even know a couple in your social network that you can work with. A real estate agent will be there to assist you in your home search and schedule home viewings.

Helping clients buy and sell homes is their thing so they will be knowledgeable in the home buying process and help you meet deadlines for a successful home purchase.

Find a realtor in your area by using the National Association of Realtors search engine.

10. Get a pre-approval before house hunting

Before you start looking at homes and attending open houses, you want to be ready in hand with a pre-approval letter. It is a very depressing feeling when you think you stumbled on the perfect house and someone snatched it up. Trust me, when I say that the goods ones go really fast!

You want to be a prepared homebuyer by getting a pre-approval letter from your lender. This will show sellers the seriousness of your offer and that you are good for the money. After you have been pre-approved for a certain amount and discussed your min and max budget for your home, it’s a good idea to ask your lender for multiple pre-approval letters.

Personally, we asked for three pre-approval letters from our lender at the low, medium, and high end of what we would be willing to offer on home. We try to start as low as reasonable and then work our way from there.

Talk to your lender to request a pre-approval letter before you go home shopping.

Tips for success in buying a home

- You can put less than a 20% down payment

- Use a mortgage broker

- Don’t compromise on your must-haves

- Use a real estate agent who meets your needs

- Be open to the potential a home has to offer

- Make a backup offer on the house you love

- Avoid making large purchases before closing

- Read all active governing restrictions to the property

- Do a home inspection and a sewer scope

I discuss these tips in detail in my 9 Best Need to Know Tips for the First-Time Homebuyers, where you will learn things you may not have considered and will become a more educated and confident homebuyer.

Conclusion

Buying a home is a big financial decision and can be a money maker or drain you dry if you’re not prepared. What it really comes down to is doing your homework on your own financial lifestyle. Doing these 10 things before buying a home will build a solid foundation for your long-term investment.

Being knowledgeable in your living expenses and spending habits will not only help you be successful in your home purchase but towards financial freedom. If it fits within your financial means and your lifestyle, then homeownership can be better than renting. Don’t try to make a home purchase “fit” in your lifestyle expenses if it doesn’t. You’ll find yourself struggling and stressed.

Whatever your reason is for buying a home, make sure it’s a good one. Everyone is on a different timeline and that’s okay. You don’t have to buy a house just because your friends are doing it or “because it’s time.”

Sending you a Little Peace of Happiness,

Related Posts:

- How to Create a Budget You Can Stick To

- 9 Best Need to Know Tips for the First-Time Homebuyers

- 21 Ways to Update Your Home on a Budget

- How to Get Started with a Home Renovation

Were these tips helpful? Which were new to you? Do you have any to add that would help a new homebuyer? Leave a Comment!

Pin Me for Later!